🧑💻 Developer-First #180 - Code war's latest episodes 🍿

Coding models, enterprise adoption, and the quiet trillion-dollar opportunity in maintaining code

Hello friend,

Last week was a perfect snapshot of where software is heading. Mistral AI and OpenAI both shipped new coding models, pushing the frontier of what machines can design, refactor, and maintain at scale. At the same time, enterprise AI adoption continues to accelerate, with companies no longer experimenting at the margins but committing real budgets to production-grade AI systems.

Put together, this points to a massive opportunity hiding in plain sight: creating, evolving, and maintaining enterprise software. As codebases grow more complex and longer-lived, and as AI becomes a first-class contributor, the market for tools, platforms, and models that help enterprises build and operate software more efficiently is on track to become a trillion-dollar category.

Now, let’s dive into this week’s signals.

P.P.S. If you’re a CTO, VP Engineering, or technical executive, you should join the Unicorn CTO community, a network of European CTOs and technical leaders who learn and connect with peers. You’ll get access to exclusive events and a private Slack group where the top engineering leaders in Europe exchange strategies every week.

Deal of the week — IBM acquires Confluent for $11 billion

Built on Apache Kafka, Confluent has become the de-facto enterprise platform for real-time data in motion, with more than 6,500 customers and deep penetration across the Fortune 500. For IBM, the deal reinforces its hybrid cloud and AI strategy by adding a critical layer: trusted, real-time data flows that AI agents and applications can actually act on.

The rationale is clear. As enterprises move toward generative and agentic AI, batch data pipelines are no longer enough. AI systems need continuously updated, governed, and reliable streams of events across clouds, datacenters, and applications. Confluent’s platform, combined with IBM’s AI, automation, and consulting footprint, positions IBM to offer an end-to-end “smart data platform” purpose-built for enterprise AI.

💭 My take: This deal confirms that real-time data infrastructure is becoming strategic AI plumbing, not just DevOps tooling. It’s now clear that controlling the data-in-motion layer is essential to owning the AI platform. Read more about this deal here. Also, you’ll find all the other transactions from last week in The Changelog at the end of this newsletter.

The Unicorn CTO Podcast - Episode 1

I’ve recently launched the Unicorn CTO Podcast, a new conversation series with senior technology leaders on scaling engineering, AI, and product at critical inflection points. The first episode is now live with Joe Moles, CTO at Red Canary, and it’s a goldmine of mental models for systems thinkers. I hope you’ll enjoy this episode as much as I did!

GPT-5.2 vs Devstral 2: two visions of AI-assisted software engineering

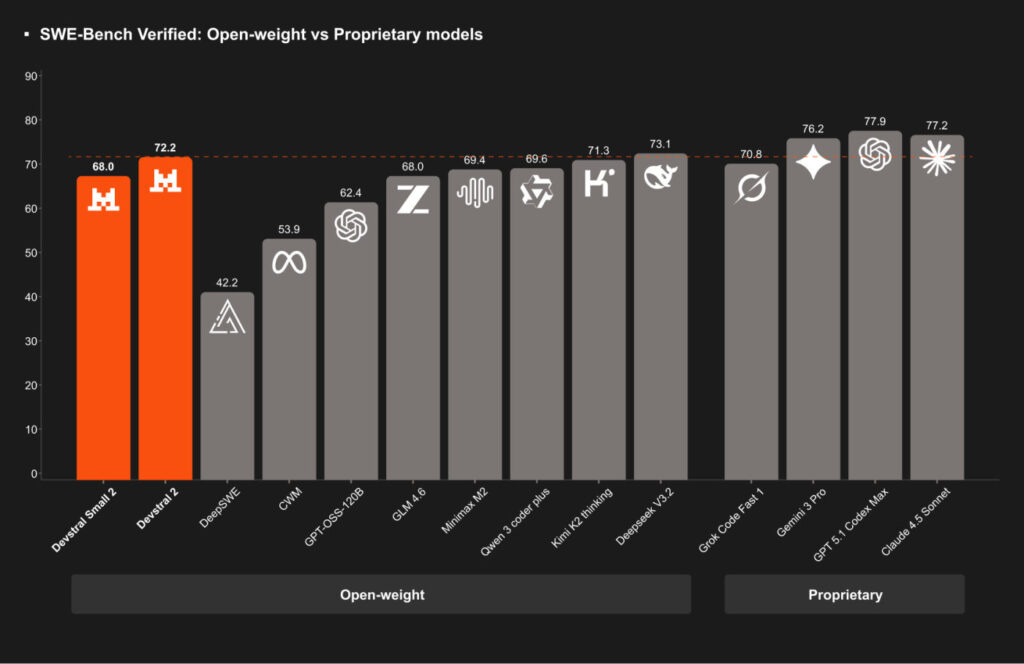

Last week saw the release of two very different coding models. On December 9th, Mistral AI released Devstral 2, its open-source answer to autonomous software engineering, reaching 72.2% on SWE-Bench Verified. Built to operate at the repo level, it shines at large refactors, systematic changes across many files, and long-running agentic tasks. It’s far more deterministic and controllable than other models, especially when self-hosted or integrated via CLI and agents.

Two days later, OpenAI released GPT-5.2, its new flagship model for professional knowledge work, including software development, with a 55.6% on the SWE-Bench Pro benchmark. In practice, GPT-5.2 behaves like a senior engineer you pair with: strong at design decisions, debugging complex edge cases, and producing clean, well-structured code with rich context, especially when coding is tightly coupled with product, infrastructure, and organisational trade-offs.

🍿 The pace and intensity of competition between coding models is now undeniable, and seeing models like Devstral 2 and GPT-5.2 leapfrog each other week after week only reinforces my conviction that software development is entering the biggest transformation it has ever experienced.

Menlo Ventures 2025 State of generative AI in the enterprise

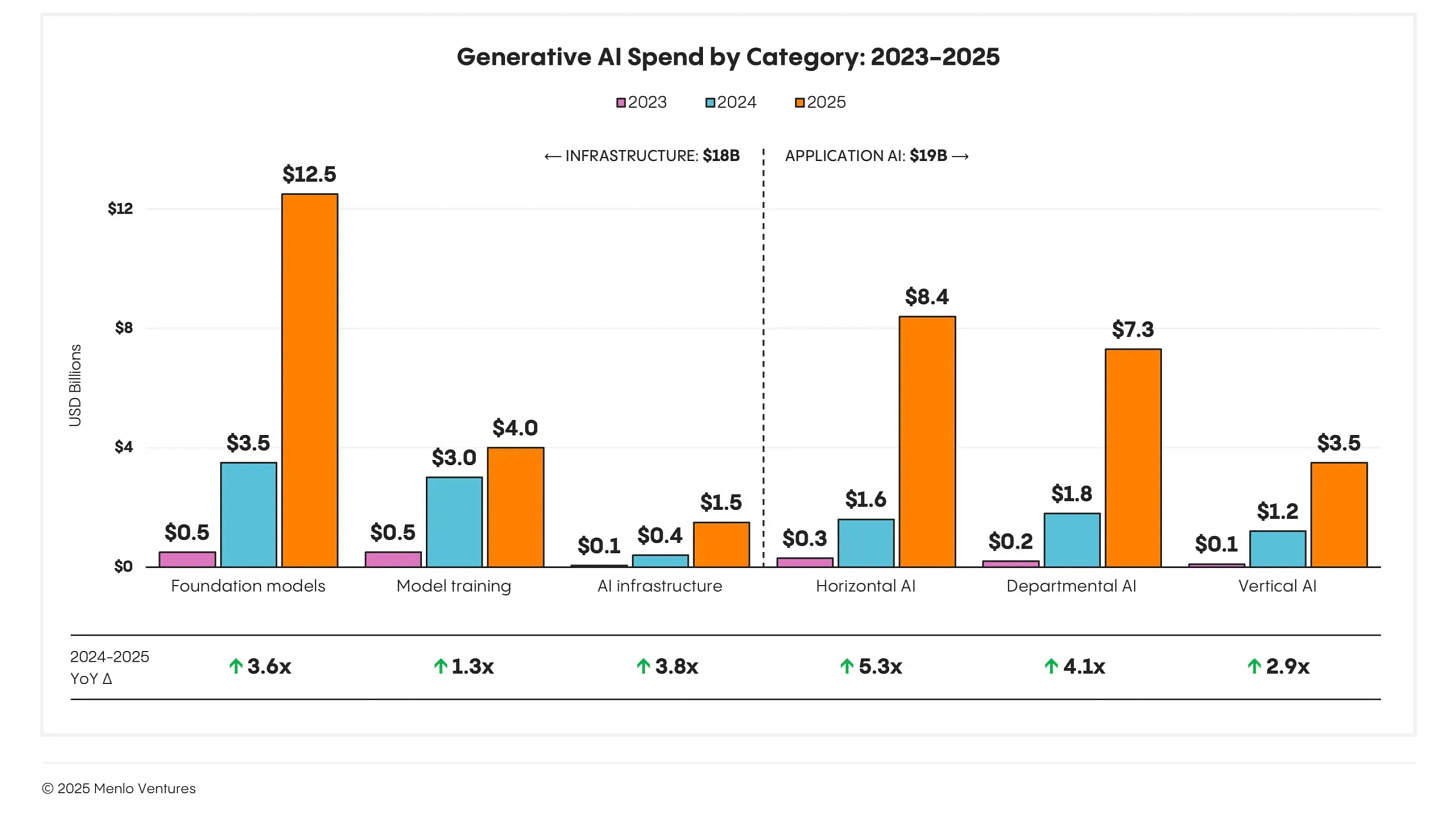

The latest Menlo Ventures Enterprise GenAI Report confirms what many operators are now seeing on the ground: enterprise AI spending has fully crossed into scale. US companies spent $37B on AI in 2025, up 3× year over year. The biggest structural shift is where that money goes: 50% of spend is now at the application layer, a fourfold increase in just one year, as enterprises prioritise solutions that deliver immediate business outcomes over raw infrastructure or experimentation.

Under the hood, the market is consolidating fast. Anthropic now captures ~40% of enterprise LLM spend, largely driven by Claude Code, while open-source LLM share dropped from 19% to 11%, with Llama dominating that remaining slice. Startups are the clear winners at the application layer, capturing 63% of spend by shipping faster than incumbents in areas like coding, sales, and finance. GTM is evolving just as quickly: PLG now drives 27% of AI spend, far above traditional software norms, and the buy-versus-build equation has flipped decisively, with 76% of enterprises now buying AI solutions rather than building them in-house.

The Changelog - Week of December 8th, 2025

Last week, 12 companies raised $679 million across 6 product categories in 5 countries. Europe-based companies attracted 10% of total funding vs 76% for North America-based companies and 15% for Asia-based companies (incl. Israel). Three of these companies distribute or contribute to an open-source project. On the M&A side, 1 company was acquired.

Funding Rounds

Harness, from San Francisco 🇺🇸 raised $240 million in Series E funding led by Goldman Sachs. Harness automates CI/CD, testing, security checks, and deployment workflows, helping teams accelerate software delivery with built-in AI capabilities. (more)

Fal, from San Francisco 🇺🇸 raised $140 million in Series D funding led by Sequoia Capital. Fal provides a developer platform for hosting and running image, video, and audio AI models at scale. (more)

Port, from Tel Aviv 🇮🇱 raised $100 million in Series C funding led by General Atlantic. Port offers an internal developer portal and agent orchestration layer that helps engineering teams centralise and automate DevOps workflows. (more)

Serval, from San Francisco 🇺🇸 raised $75 million in Series B funding led by Sequoia Capital. Serval automates IT workflows for enterprise teams using AI, transforming service management into a proactive and intelligent process. (more)

Runware, from London 🇬🇧 raised $50 million in Series A funding led by Dawn Capital. Runware provides real-time image, video, and audio generation tools that power the next generation of intelligent applications. (more)

Prime Security, from New York 🇺🇸 raised $20 million in Series A funding led by Scale Venture Partners. Prime Security develops autonomous AI agents that perform design-stage software security reviews, identifying risks before code is deployed. (more)

Interchange, from Portland 🇺🇸 raised $17 million in Seed funding. Interchange builds correspondent clearing infrastructure and developer tools for securities products. (more)

Equixly, from Florence 🇮🇹 raised $11.6 million in Series A funding led by 33N Ventures. Equixly offers AI-powered software for API penetration testing and automated security validation. (more)

Typecast, from San Mateo 🇺🇸 raised $11.5 million in funding led by Intervest. Typecast provides a synthetic voice and video generation platform for creators and enterprises. (more)

Kilo Code, from San Francisco 🇺🇸 raised $8 million in Seed funding led by Cota Capital. Kilo Code develops an open-source coding agent designed to accelerate AI-driven software development. (more)

Corma, from Paris 🇫🇷 raised $3.9 million in Seed funding led by XTX Ventures. Corma helps teams manage internal software stacks by optimising tool usage, lowering costs, and improving efficiency. (more)

Empromptu AI, from San Francisco 🇺🇸 raised $2 million in Pre-Seed funding led by Precursor Ventures. Empromptu AI helps companies build self-improving AI applications capable of managing their own context and behaviour. (more)

M&A Transactions

Confluent, from Mountain View 🇺🇸 was acquired by IBM for $11 billion. Confluent provides a data streaming and infrastructure platform centred on Apache Kafka, enabling real-time data pipelines for enterprise AI systems. (more)

Fantastic breakdown of how AI coding tools are reshaping enterprize development! The Equixly mention caught my attention because automated API secuirty testing is where I think a lot of companies are gonna struggle once they deploy AI-generated code at scale. A lot of orgs dunno that legacy pentesting workflows cant keep up with the velocity that Devstral or GPT-5 enable, which creates this weird blind spot where code ships faster but vulnerabilities just stack up silently.