🧑💻 Developer-First #160 - 3-Year Gap and Sky-High VC Expectations for Series B in 2025

The bar for post-Series A funding has never been higher

Hello friend,

Founders planning to raise a Series B in 2025 should be prepared for a significantly longer journey and far more rigorous investor scrutiny.

Since 2022, the number of startups raising a Series B within two years of their Series A has dropped dramatically. At the same time, the median time between Series A and Series B continues to increase.

Why? Most companies that raised a Series A in 2023 or later are now demonstrating stronger fundamentals than in previous years, with higher ARR, better traction, lower churn, and improved operational efficiency.

As a result, VCs have significantly raised the bar. Simply put: unless your metrics are exceptional, you won’t get the meeting. If you’re a post-Series A founder or investor with €5–10M in ARR, here’s how to assess your situation:

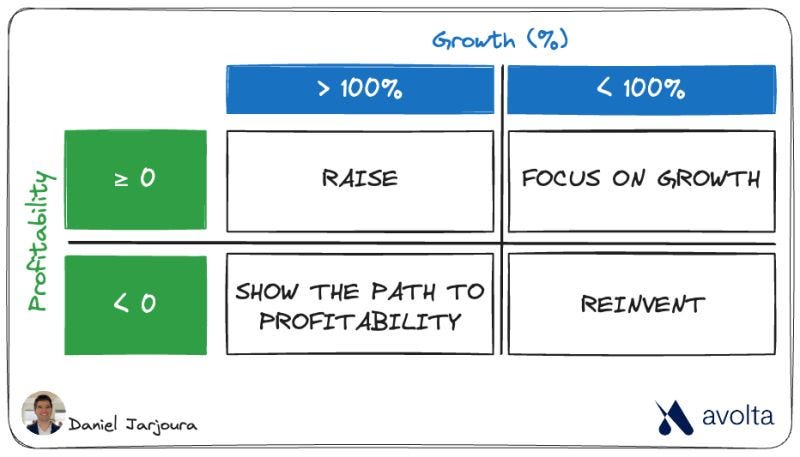

🟢 >100% Growth, Positive EBITDA

You’re in an excellent position to raise. Chances are, VCs are already chasing you.

🟠 <100% Growth, Positive EBITDA

Focus relentlessly on growth. Profitability helps, but growth still drives valuations—especially as macro uncertainty recedes.

🟠 >100% Growth, Negative EBITDA

You can raise—but do it quickly, and only if you can show a clear path to profitability within 12 months.

🔴 <100% Growth, Negative EBITDA

You need to pivot. Either reach profitability, move upmarket or rebuild your core product with AI.

And for those who are still pre-Series A, their best bet might be to make the Series A their last raise.

P.S.: I relaunched my Unicorn CTO cohort-based online program for CTOs and managers looking to efficiently scale their teams and become better leaders in the age of generative AI. The last session sold out in just a few days, so I’ve added a new September session with only a few seats remaining. Click here to learn more and secure your spot!

Now, let's dive into last week's developer-first transactions.

💰 Market Summary - Week of June 30th, 2025

4 companies raised $119.7 million across 4 product categories in 3 countries.

Europe-based companies attracted 95.8% of the total funding vs 4.2% for North America-based companies.

Robotics is the category that attracted the highest funding.

2 companies provide or contribute to an open-source product.

0 company was acquired last week.

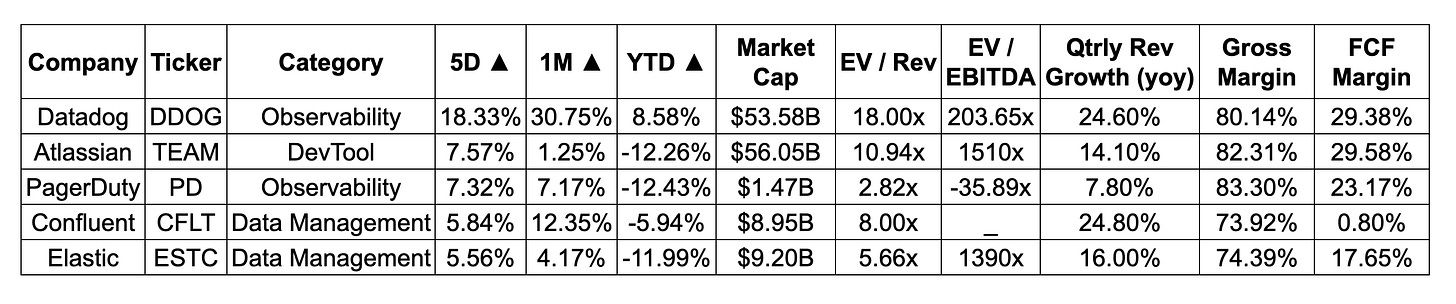

📈 Top 5 Weekly Share Price Movement

In this new section, I’ll share the top 5 share price movements for developer-first and software infrastructure public companies. Let me know what you think!

🧩 Funding by Product Category

🌎 Funding by Region

🏢 Funding By Company

Genesis AI, from Paris 🇫🇷 raised $105 million in Seed funding led by Eclipse Ventures and Khosla Ventures. Genesis AI is a full-stack robotics company building generalist robots to unlock unlimited physical labor, freeing humans to focus on creativity and curiosity. (more)

TopK, from San Francisco 🇺🇸 (and originally from Prague 🇨🇿) raised $5.5 million in Seed funding led by Earlybird Venture Capital. TopK delivers highly relevant search results, allowing engineering teams to stay focused on building great products. (more)

North.cloud, from New York 🇺🇸 raised $5 million in Series A funding led by Companyon Ventures. North.Cloud helps companies manage, optimise, and automate cloud spend in real time, giving FinOps and engineering teams visibility and control. (more)

RevEng.ai, from London 🇬🇧 raised $4.2 million in Seed funding led by Sands Capital. RevEng.AI develops deep learning models that understand binary machine code to secure software supply chains at a binary level. (more)

🤝 Mergers & Acquisitions

No transactions last week

⭐️ Trending GitHub Repositories

microsoft / generative-ai-for-beginners (✩ 5,042 stars this week) - 21 Lessons, Get Started Building with Generative AI.

GraphiteEditor / Graphite (✩ 4,676 stars this week) - An open source graphics editor for 2025: comprehensive 2D content creation tool suite for graphic design, digital art, and interactive real-time motion graphics — featuring node-based procedural editing.

twentyhq / twenty 🇫🇷 (✩ 3,340 stars this week) - Building a modern alternative to Salesforce, powered by the community.

👍 Trending Developer Tools on ProductHunt

Cursor Agents: Browsers & Mobile (👍 696) - You can now work with Cursor Agents on web and mobile. Just like the familiar agent that works alongside you in the IDE, agents on web and mobile can write code, answer complex questions, and scaffold out your work.

Portia AI (👍 647) - Portia lets you ship production-grade AI agents fast. With plug-and-play tool integration, declarative planning, and a unified auth framework, you can deploy secure, reliable agents across API and web with full human oversight and control.

String.com (👍 559) - Prompt, run, edit, and deploy AI agents in seconds.